The "Widow Maker" trade is back, but this time, the catalyst isn't just yield curve control—it’s a full-blown fiscal regime change in Tokyo. While retail traders attempt to catch falling knives on the Yen based on overbought RSI signals, institutional desks are navigating a complex interplay of snap elections, exploding JGB yields, and the looming threat of Ministry of Finance intervention.

We have analyzed the latest private client notes from Goldman Sachs, J.P. Morgan, Société Générale, Mizuho, and Lloyds. The consensus is shifting: the Yen is being sold not just on interest rate differentials, but on a structural deterioration of Japan’s fiscal discipline.

Executive Summary: The Institutional Consensus

- The "Takaichi Trade" Dominance: Mizuho and J.P. Morgan identify the driving force of Yen weakness as the "Takaichi Trade"—a bet on aggressive fiscal expansion and tax cuts following the expected snap election on February 8.

- The JGB "Meltdown": J.P. Morgan describes the Japanese Government Bond (JGB) market as looking "unhinged," with 10-year yields hitting levels not seen since 1999. This bond market rout is fueling Yen depreciation.

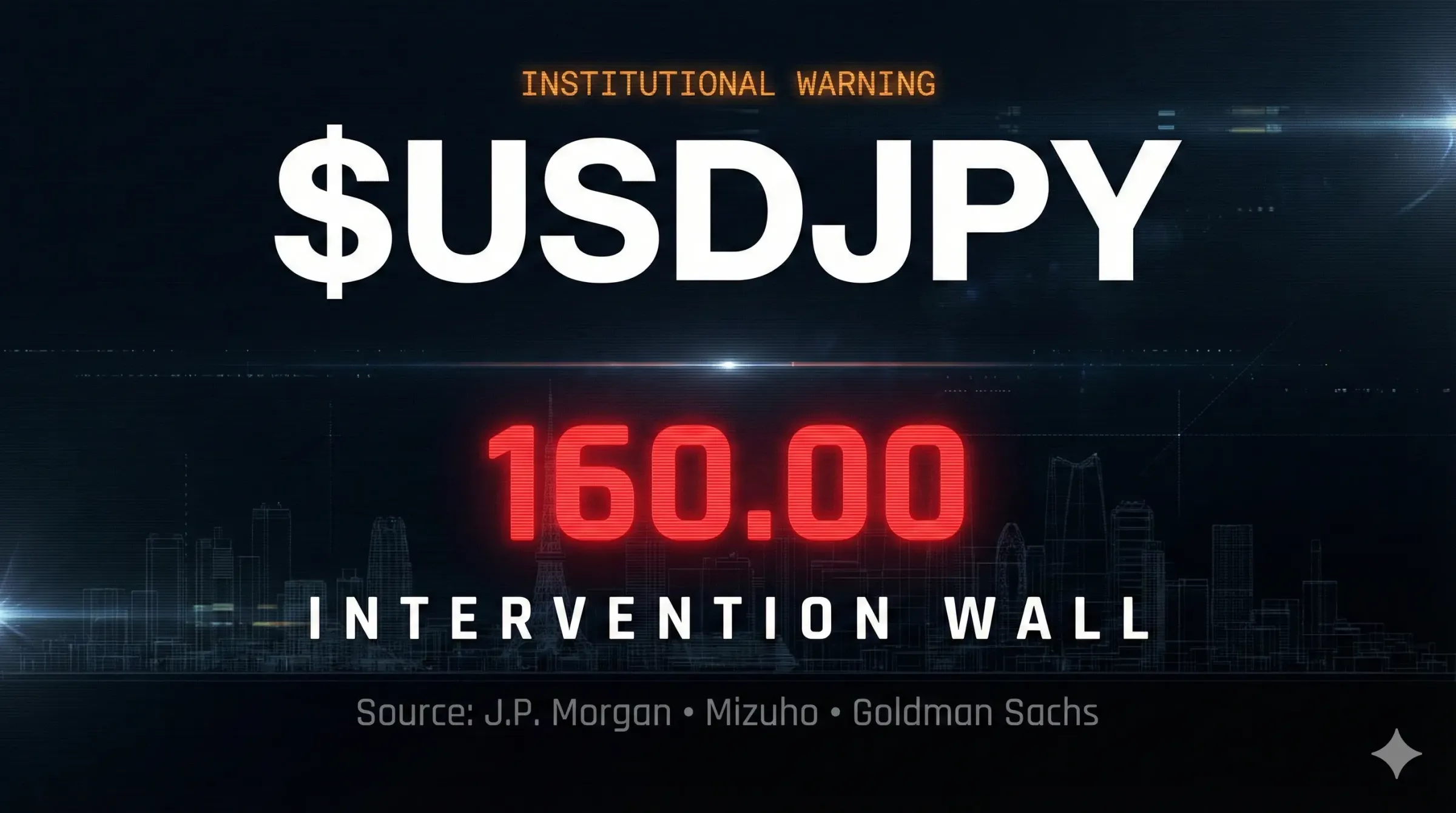

- The 160.00 "Danger Zone": While the technicals point higher, Goldman Sachs and ING warn that the 159.00–160.00 zone is now critical "intervention territory," capping immediate upside despite the bullish momentum.

The Institutional Argument: Why The Banks Are Selling Yen

The narrative has moved beyond simple Fed vs. BoJ policy divergence. The banks are now pricing in a political risk premium specific to Japan.

1. Fiscal Discipline is "Unhinged" (J.P. Morgan & Mizuho)

The most striking commentary comes from J.P. Morgan’s desk, which notes that JGBs look "unhinged across the curve." The market is reacting to Prime Minister Takaichi’s election pitch to cut taxes, which implies looser fiscal policy. Mizuho reinforces this, noting that the "Takaichi trade"—characterized by rising equities, higher interest rates, and a falling Yen—is in full swing. The market believes the ruling coalition will prioritize spending over fiscal health, eroding the currency's value.

2. The BoJ is "On Hold" (Goldman Sachs & UniCredit)

Despite the collapse in the Yen, the institutions do not expect an immediate rescue from the central bank. Goldman Sachs expects the Bank of Japan to maintain the status quo at the January meeting. Their economists argue that while the BoJ is shifting toward steady rate hikes, the next move isn't expected until July 2026. UniCredit agrees, stating the BoJ needs to confirm wage-price sustainability before moving again. This leaves the Yen exposed to carry traders for another quarter.

3. The Intervention "Bluff" (MUFG)

MUFG highlights a massive buildup in speculative shorts—the largest one-week increase since 2011. They note that the market seems unconcerned by the risk of intervention despite verbal warnings from officials. However, they remain skeptical that the Yen can hold up solely on intervention threats if the underlying JGB sell-off continues.

The Technical Landscape: The Path to 162.00

Technically, the structure is bullish, but we are entering a zone of extreme historical resistance.

The "Blue Sky" Targets

- Société Générale: The technical desk is the most aggressive, calling for a move to 160.70 and eventually the 2024 peak of 162.00. They cite a confirmed breakout from a base and strong momentum.

- Lloyds: Also bullish, targeting the long-term high of 161.95. They view dips as buying opportunities within the current trend.

The Support Levels (Buy Zones)

- J.P. Morgan: The desk notes that 157.30/40 held well during recent sessions and is a key intraday support pivot.

- Société Générale: Identifies the 50-Day Moving Average at 156.00 as the "line in the sand." As long as price remains above this, the uptrend is intact.

The "Intervention" Cap

Goldman Sachs sees the near-term range capped at 155-160. They argue that rising odds of intervention will limit upside beyond the 160.00 handle, even if fundamentals suggest the Yen should be weaker. ING concurs, noting that a move toward 160.00 invites direct Ministry of Finance action.

Note: Several desks have identified a specific invalidation level below the 157.00 handle. A daily close below this secret level would signal a false breakout and trigger a liquidation of the "Takaichi Trade."

The Verdict: Conflict or Consensus?

There is a Tactical Consensus on Yen weakness, but a Strategic Conflict on how to trade it.

The Consensus:

Every major bank analyzed—from Citi to Scotiabank—agrees that the path of least resistance is higher for USD/JPY in the immediate term due to the Japanese election cycle. There are no major "Sell USD/JPY" calls for the current week.

The Conflict:

The disagreement lies in the vehicle of choice.

- J.P. Morgan is happy to hold USD/JPY longs, riding the bond market volatility directly.

- Goldman Sachs, however, is more cautious on the US Dollar leg. They explicitly state a preference for Long EUR/JPY over USD/JPY. They fear US data softness could derail the USD side of the trade, whereas the Euro allows for a cleaner expression of Japanese fiscal weakness.

Knowing Where to Strike

The macro thesis is undeniable: Japan is printing money (fiscally) while the US holds rates high. But buying USD/JPY at 158.50 places you directly in the crosshairs of the Bank of Japan’s intervention desk.

The difference between profit and a margin call is knowing exactly where the "Smart Money" has placed their stop losses.

We have access to the specific entry orders, invalidation levels, and stop-loss placements from the J.P. Morgan and SocGen trading desks. They aren't chasing the breakout blindly—they are waiting for specific liquidity pools to engage.

Don't guess the intervention level. Trade with the institutions.

Unlock the Full Bank Reports and Get the Institutional Trade Levels at FxDesk.ai